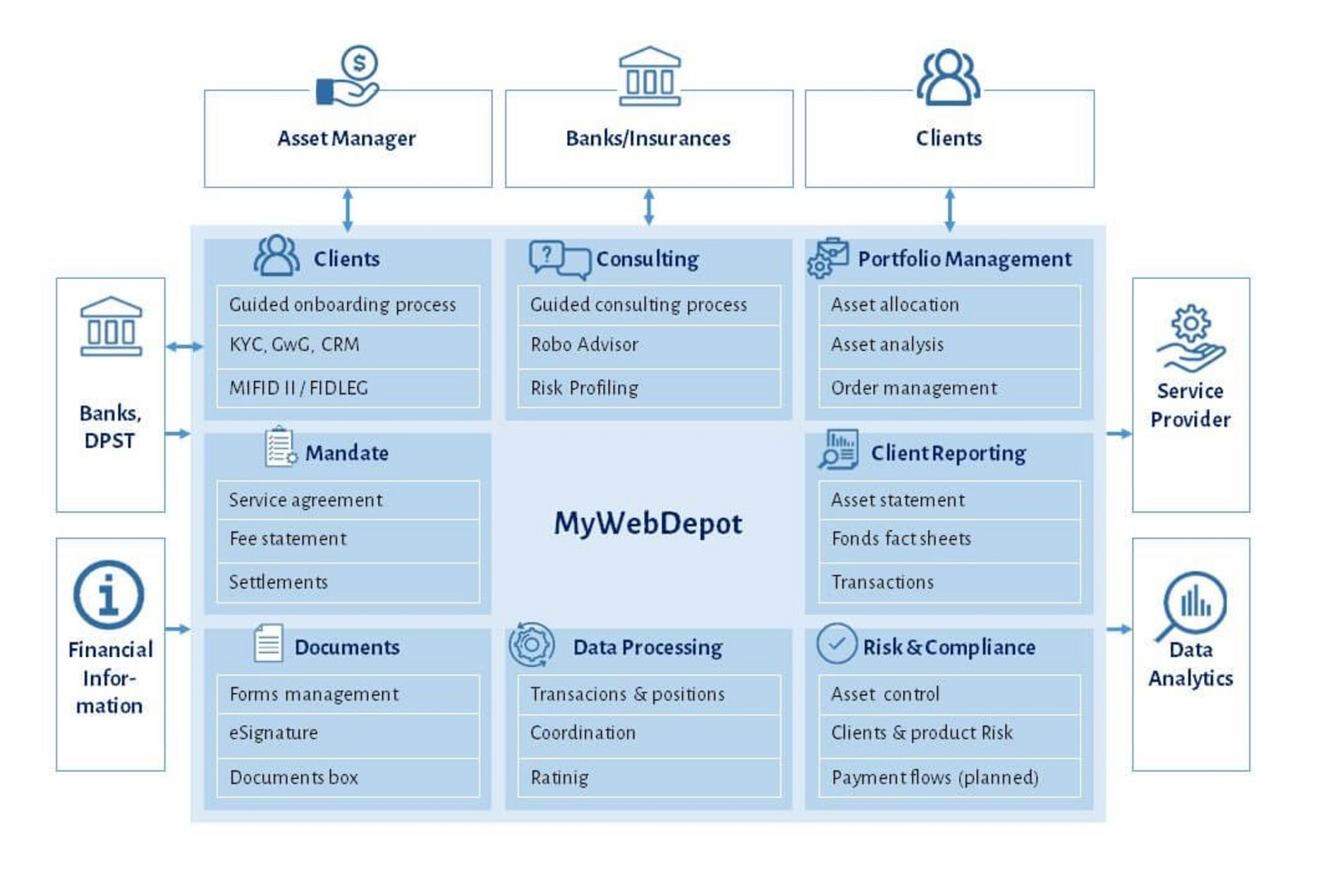

MyWebDepot is a portfolio management system that covers all your needs in a single web solution. The comprehensive asset management platform supports you throughout the entire life cycle and helps you comply with the latest regulatory requirements.

MyWebDepot is a highly customizable asset management platform that can be used by businesses of any size to help manage, monitor and document client assets. Attract new clients with easy client onboarding and benefit from efficient contract management. Sales organizations, insurance companies, asset managers, investment companies and banks of all sizes rely on our expertise.

Your contact

Roberto Soglio

Head of Marketing & Sales«MyWebDepot is the result of more than 20 years of market experience and development. The SaaS solution is being constantly adapted to current and contemporary technical and regulatory requirements.»Send email

SOBACO Solutions AG is a member of OpenWealth

More on the topic:

Press Release, October 5, 2023

MyWebDepot at a glance

Client Life Cycle Management

Comprehensive FIDLEG and MiFID II client life cycle management with guided onboarding process to collect/manage all required regulatory and KYC data.

Mandate – Service Agreement

The agreed service can be complemented with an investment strategy and fee specification, and monitored and billed based on set parameters.

Consulting

Efficient, guided investment advisory process to create customized investment proposals. For new investments and reallocations, this is done on the basis of securities recommendation lists and taking into account the risk ratios.

Portfolio Management

Consolidated overview of assets and characteristics at the level of client, family, company, distributor, custodian or assets. For investment strategies, defined tolerance values can be monitored and necessary investment adjustments due to changing market situations can be easily evaluated. Asset reallocations can be easily carried out with individual or global orders and with investment adjustments in the asset allocation model.

Risk & Compliance

Review and approval of new clients or changes to defined client parameters. Periodic documentation of agreed investment strategies ensures that adjustments can be reviewed and monitored. Monitoring of profit and loss thresholds with automatic reporting to consultants or to Compliance in the event of a violation.

Client Reporting

Clear presentation of a client’s entire portfolio and banking relationships, including positions and transactions.

Documents

Contracts and documents can be automatically enriched with data from the client life cycle management or consulting process. The client can sign all documents electronically.